Portland Business License How-To Guide

There are 11 Steps to getting your Portland Business License

The application process is completely free for account creation. There may be applicable taxes payable to the City of Portland for earnings while utilizing the business license that you obtain.

Navigate to the City of Portland Revenue Division website HERE - Keep this Page open for reference!

Under the Businesses select the option for Register My Business

1) Business Information

Under Entity information, ‘Business Tax Entity Type’ choose the Business Tax Entity Type you are creating (Most drivers choose Sole Proprietor).

Under ‘ID Type’ select from either ‘Individual Taxpayer Id Number’ or ‘Social Security Number’ and input that number below

Fill in your personal information in Individual Name

Select No when asked if you do business under a different name

Enter today’s date for Business Start Date and Oregon for State of Incorporation

Under Business Activity Description enter “TNC Driver”

Select NEXT once all fields are populated

2) Business Address

Enter your home address for Primary Business Location

Once the address has been entered, select Verify Address to confirm location.

Select No for “Does your business have a different mailing address”

Once information is entered select NEXT

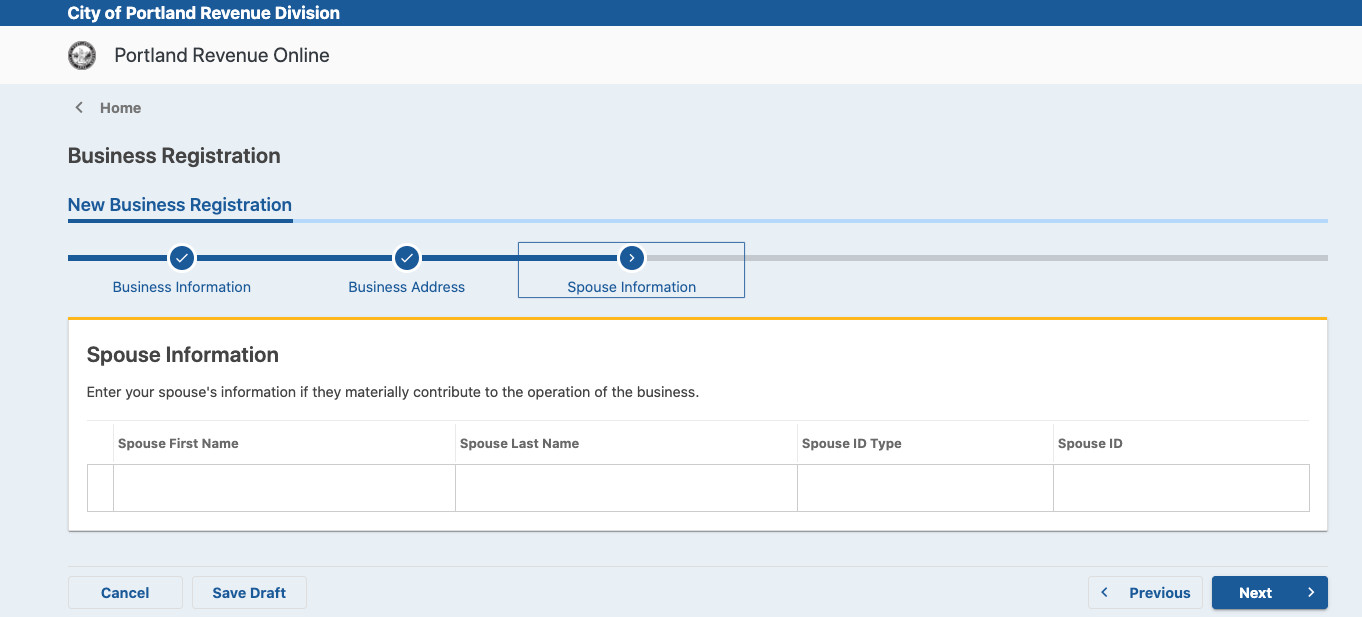

3) Spouse Information

Optional Step - add your spouse in the event that you both intend to drive for a Rideshare provider.

Select NEXT once completed

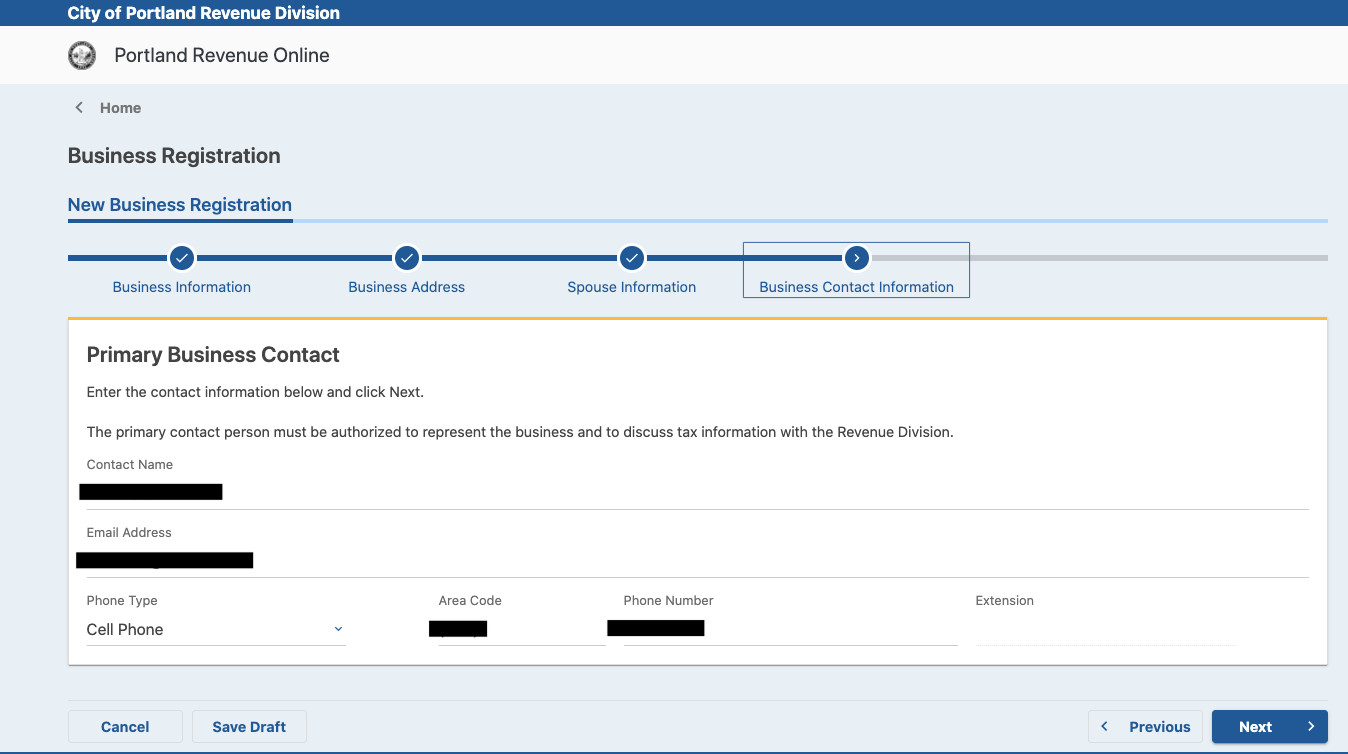

4) Business Contact Information

Enter your Contact information and select NEXT

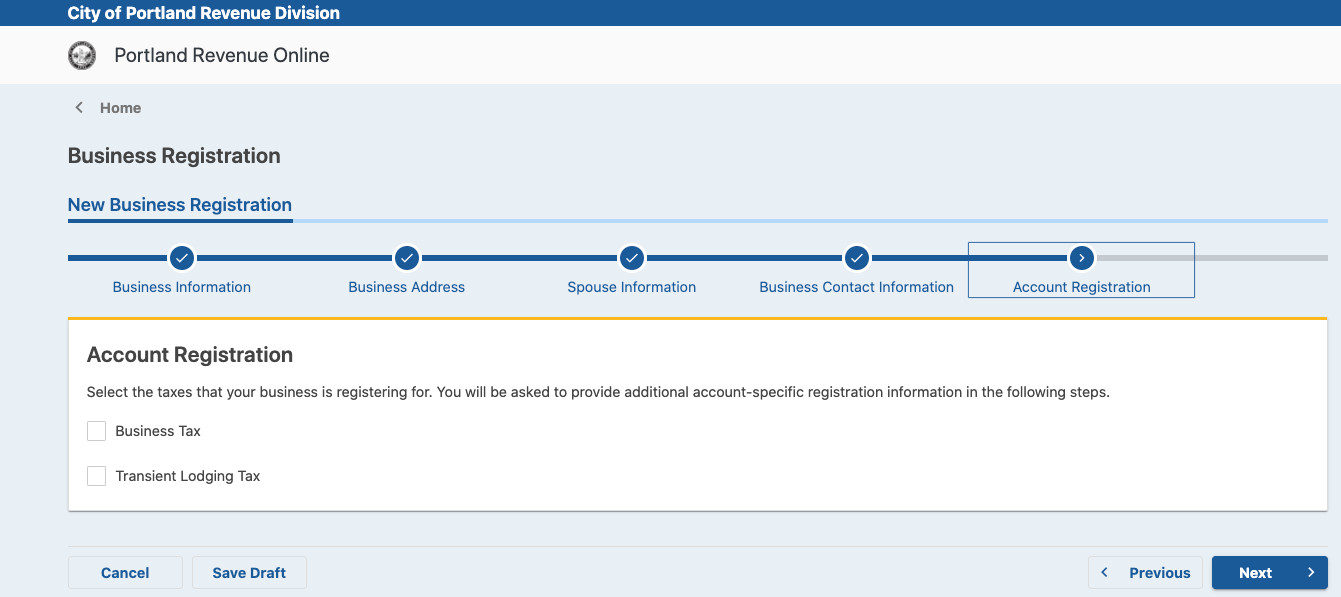

5) Account Registration

Select Business Tax and then click NEXT

6) Business Tax

For “Business Activity is conducted in the City of Portland” select YES and enter today’s date for Business Start

For “Business Activity is conducted in Multnomah County” select YES and enter today’s date for Business Start

For “Business Activity is conducted in Metro Jurisdiction” select YES and enter today’s date for Business Start

For “Is your estimated business gross income over $5 million?” select NO and continue

Enter Contact Information and then click NEXT

7) SHS Metro (Supportive Housing Services) Withholding Tax

For “Do you need a Withholding account?” Select the option that best suits your current situation (Yes or No) and then click NEXT

8) PFA (Preschool For All) Withholding Tax

For “Do you need a Withholding account” Select the option that best suits your current situation (Yes or No) and then click NEXT

9) SHS (Supportive Housing Services) Personal Income Tax

For “Do you need a Personal Income Tax account” Select the option that best suits your current situation (Yes or No) and then click NEXT

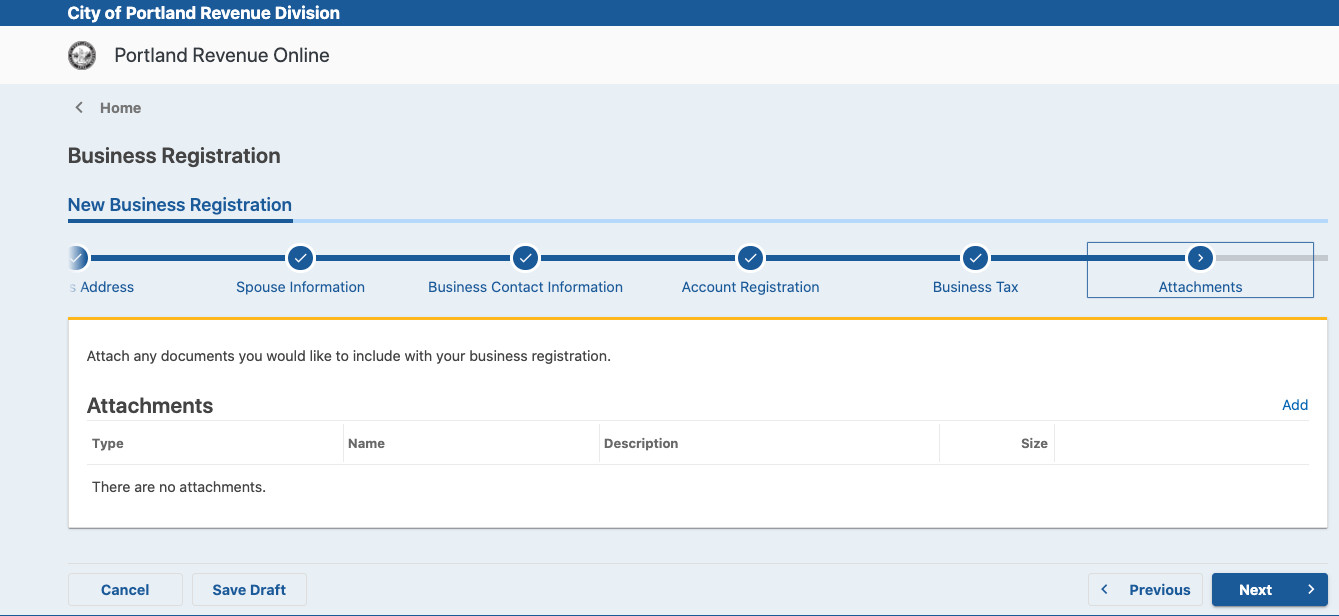

10) Attachments

Add any documents that you want to include with your registration

If you have nothing to contribute click NEXT

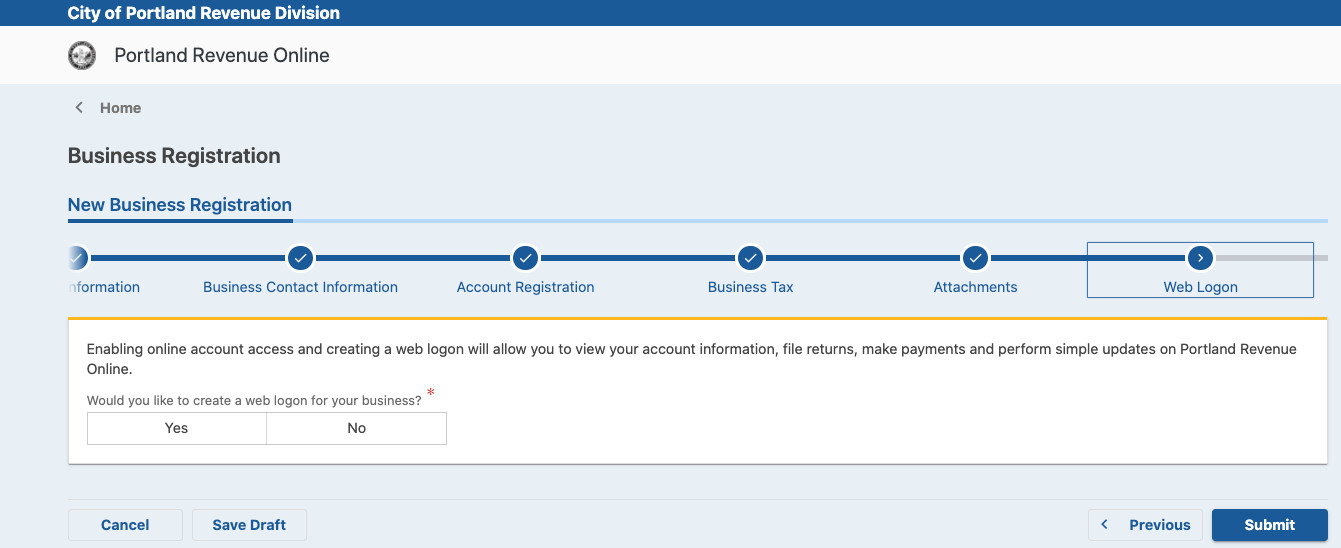

11) Web Login

Select YES when prompted to create a Login for your business

Enter the necessary information below to create your Profile for the Web Login

Once completed select Submit

To view your Business License Number

Login to your account using the Web Login Information you created in the final step

Your account number will be displayed in the Business Tax Section

It will start with BZT- and be followed by 10 Digits

Let Lyft know you have your Portland Business License

Let us know:

To complete your application, upload your Portland Business License number directly to your Driver Dashboard.

Or

Send our Support Team your Portland Business License number.

Additional Questions About the Portland Business License?

Visit the Lyft Portland Hub at 2712 N Mississippi Ave, Portland, OR 97227, or contact the Department of Revenue directly.

Department of Revenue contact information:

Email: BizTaxHelp@portlandoregon.gov

Phone: (503) 823-5157

*Please note the Lyft Hub or Express Drive locations may not be able to answer all questions regarding the status of your business license